The revision of the Electronic Bookkeeping Law will come into effect in January 2022.

While the requirement to store paper books and forms electronically has been relaxed, the requirement to store electronic transaction data has a major impact on businesses.

We will explain the outline of the revision of the Electronic Bookkeeping Law and the correspondence points of electronic transactions, especially the ordering business that is of great interest to many companies.

What is the electronic book storage method?

The Electronic Bookkeeping Law (Electric Book Law) allows taxpayers to save their national tax-related books and documents by electromagnetic records in order to reduce the amount of retention.

Book documents that previously had to be saved on paper are now allowed to be saved as electronic data such as scanned documents under certain conditions.

In addition, although it was obligatory to save transaction information of electronic transactions via EDI and the Internet as electronic data, it was also permitted to output the electronic data on paper and save it. Therefore, the fact is that data storage for electronic transactions is not very widespread. When storing electronic books, it was necessary to clear the strict requirements related to electronic storage, such as obtaining the approval of the tax office chief in advance.

Outline of revision of the Electronic Bookkeeping Law

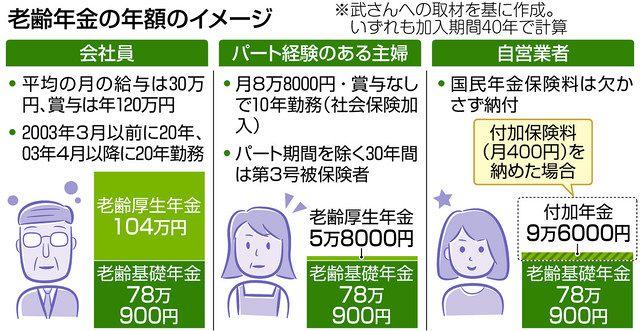

Therefore, based on the digitization of the economy and society, the NTA revised the Electronic Bookkeeping Law in the tax system revision of the 3rd year of the Ordinance in order to improve productivity and bookkeeping level by digitizing accounting. The main amendments to the Electronic Bookkeeping Law, which will come into effect on January 1, 4th year of Reiwa, are as follows.

Figure 1: Main revision points of the Electronic Bookkeeping Law

The books and documents received in writing and the copy issued by the company can be saved in writing or data as before, but the approval of the tax office chief, which was required when starting the operation of electronic book keeping, is revised this time. It is no longer needed. In addition, the requirements for scanner storage have been relaxed, making it easier to facilitate digitization.

On the other hand, strict data storage is obligatory for electronic transactions. Until now, it was possible to output and save in writing, but after the revision, it will no longer be possible to save in writing. The requirements for data storage in electronic transactions have been strengthened as follows, so be sure to check carefully when considering how to deal with it.

Figure 2: Data storage requirements for electronic transactions

Electronic transaction data, like paper books and documents, needs to be stored for a legal number of years and must be tamper-proof. In the case of PDF, it must be time-stamped by the sender or given by the receiver. If it is not time stamped, it must be a system that cannot be corrected or deleted, or a system that can check the history of corrections and deletions, as described in the data storage requirements.

And the data storage mechanism requires a searchable mechanism in preparation for tax audits. There are three search items, "date", "account", and "amount", and "date" and "amount" require a search function by specifying a range.

If a system that meets these requirements cannot be prepared, it is necessary to formulate paperwork rules and thoroughly operate the system so that the data will not be tampered with. However, it is a heavy burden on the site to operate according to the regulations, so it should be handled by system construction or cloud service compatible with the Electric Book Law.

In addition, the tax reform outline of the 4th year of the Ordinance includes a transitional measure to postpone until December 31, 2023 for the smooth transition to the preservation of electromagnetic records related to transaction information of electronic transactions. Let's promote the establishment of a storage system for electronic transactions from the work that can be handled, and promote paperless and DX (digital transformation).

・ For details on the Electronic Bookkeeping Law, please see the NTA website. https://www.nta.go.jp/law/joho-zeikaishaku/sonota/jirei/index.htm

・ Anytime viewing >> [Electronic book storage method] Support for the electronic book method in EDI (web, mail), which will increase in the future, and seminar on automation / efficiency improvement by RPA https://www.usknet.com/archives/20211119webinar/

What is the target electronic transaction?

We have explained the amendments to the Electronic Bookkeeping Law and the necessity of storing electronic transaction data, but what are the target electronic transactions? Let's take a concrete look at the ordering operations that require compliance with the Electric Book Law.

(1) Orders, shipments, billing data, etc. by EDI (2) Downloading, uploading, etc. of order data by WebEDI (3) Data received on the EC site, receipts purchased on the EC site, etc. (4) Orders received by e-mail, etc. Ordering, etc. (5) When receiving a fax with a multifunction device and saving it as data, etc.

(1) In EDI, it is often managed by an information system, the business process is clear, and it can be said that it is easy to consider how to deal with the electric book method. However, in general, EDI received data is often deleted once it is imported into the core system, so store it in a database that can be searched by "date", "customer", and "amount".

(2) WebEDI is a method of accessing the ordering site of a business partner and downloading the target data. Since the person in charge mainly operates it manually and there are many cases where there is no manual, it is necessary to take this opportunity to identify the ordering work by WebEDI and prepare how to store the data.

(3) If the product is sold on the EC site, it is necessary to save the data for downloading the order data as well as WebEDI. In addition, receipts for purchasing office supplies and equipment from the EC site must also be stored as screenshots of the browser screen or PDF.

(4) Orders and invoices attached to e-mail are also electronic transactions. Even if the transaction details are described only in the body of the email, it will be an electronic transaction. It is necessary to store the email itself or save the email body as a PDF.

(5) In the case of fax, if it is received by a multifunction device or computer and stored as it is, it will be an electronic transaction.

Figure 3: Specifics of electronic transactions in ordering operations subject to the Electronic Bookkeeping Law

The above ordering business is an example of electronic transactions. It also includes tasks that the information system department does not know, such as WebEDI and email that the person in charge handles individually. Let's take an inventory of the business and consider how to deal with the Electric Book Law, as to what kind of electronic transactions are in which department.

Correspondence points in ordering business

Now, let's introduce how to deal with the electronic book method of ordering and receiving business by electronic transactions, focusing on EDI, WebEDI, and e-mail. Saving electronic data is an example of using a document management service. The process is important as to how to save electronic transaction data without any hassle, so please check what kind of procedure is required in light of your company's business. Here, the receiving business is explained as an example, but the same concept applies to the transmitting business.

(1) Compatible with EDI's electric book method

Since the data layout of EDI is different for each business partner, many companies also manage received files individually. It is often the case that an individual program is created for each received data and linked with the core system. In this case, in order to save the data in the document management system, it is necessary to register the search key (date, business partner, amount) for each received data. As the number of business partners and messages increases, the work becomes enormous, so let's also consider improving efficiency such as automating with RPA (Fig. 4).

Figure 4: EDI correspondence example of the electric book method ①

Although saving to the document management system can be automated by RPA, the operation of each received file becomes complicated to manage. Therefore, in order to improve the management of each received data, it is recommended to use a standard DB (database). Figure 5 shows an example in which the received files for each business partner are centrally managed by the standard DB of the distribution BMS of our EDI system "EOS Master". By building a standard DB by "EOS Master" or your own company, data linkage with document management system and core system can be centralized and maintainability is improved. If you have many EDI customers, collect the received data in the standard DB.

Figure 5: Correspondence example of EDI's electric book method ②

(2) Support for WebEDI's electric book method

Web EDI, which downloads data from the customer's ordering site, has the same support as EDI. Upload the search key and data to the document management system for each downloaded file. Data download and upload can be automated by RPA, but as explained in EDI, it is better to centrally manage the data in the standard DB. Figure 6 shows a pattern in which EDI and Web EDI are centrally managed by a standard DB and linked with a document management system.

Figure 6: EDI and WebEDI compatible with the electric book method

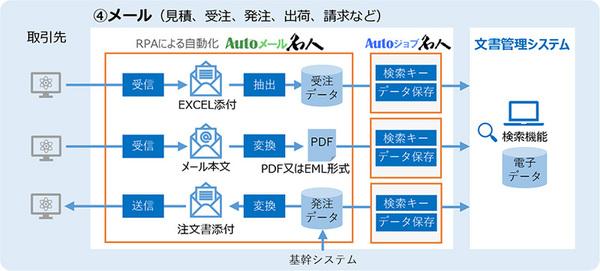

(3) Correspondence to the electric book method of mail

There are various types of ordering work by e-mail such as quotation, ordering, ordering, shipping, and billing. Most of them are emails addressed to the person in charge. There are various data formats such as attachments such as EXCEL, CSV, and PDF, as well as transaction information written in the body of the email. All of them require electronic data storage.

I would like to automate these series of mail operations with RPA. However, general RPA that memorizes and automates screen operations may not be able to handle the automation of mail operations well. You need to identify the target email from the inbox folder and decide what to do with the email. In addition, complicated processing is required, such as the password for decompressing the attached file is sent by another e-mail, and the data is extracted from the attached file and saved. In addition, emails are sent to various people in charge, so it is necessary to aggregate all the items to be saved. You also need to consider what to do if the wrong email is sent.

"Auto Mail Master" is an RPA dedicated to mail with a built-in mailer and data conversion function, and can reliably automate such complicated mail operations. If you receive and receive many orders by e-mail, why not consider automating using "Auto Mail Master"?

Figure 7: Correspondence to the electric book method of mail

To companies using the "Master Series"

Each company has its own policies regarding the storage of books and documents, scanner storage, and electronic storage, and in many cases the accounting department is the center of operation for the document management system. Here, we will introduce what to do with the transaction data of the "master series" used in the ordering business.

"EOS Master"

It is permitted to save not only the data itself immediately after receipt, but also the data whose transaction details have been edited by a rational method. In other words, it is possible to save the converted data in the standard DB by the data conversion function of "EOS Master". Then, it is necessary to keep the history of correction and deletion or to specify the operation rule that cannot be corrected and deleted, and to save the legal number of years. Companies that delete and operate data on a regular basis are requested to prepare a mechanism for saving EDI data, such as backing up the data before deletion.

In addition, USAC System is planning to provide a cloud service in 2022 (first half) that can store the standard DB of "EOS Master" for a long period of time and has a search function compatible with the electric book method.

"I Master"

Both the ordering system and the procurement system need to store data that supports the electric book method. Since the DB of "i Master" does not have a function to leave a history when correcting and deleting, when saving data as it is to comply with the Electric Book Law, it is necessary to specify the operation rule to keep the history of correction and deletion of data. increase. If you want to save the data as "i Meijin" and comply with the Electric Book Law, please contact us.

"FAX Order Master"

Even if the order form by fax is processed and saved as data, it will be an electronic transaction and must be saved. "Fax Order Master" provides a mechanism to save faxes, but you must be able to search by "date", "account", and "amount", which are the requirements of the Electric Book Law. Of these, I think that many companies do not use "amount" as a key item. In the future, please enter it as a "amount" item in the remarks and use it as a search item.

"Invoice Master"

In addition to issuing the invoice on paper, the "invoice master" can send the invoice data to the shipping company online for a pickup request. Such an operation method is called transportation EDI, but the collection request data to the transportation company is also an electronic transaction. Unlike companies that actually do business, invoices are rarely operated including freight charges, so please save the data using "date" and "business partner (= shipping company)" as the search key. According to the Electric Book Law, transaction information without "amount" should be searchable if the amount is "0" or "blank".

summary

While the requirements have been significantly relaxed in order to encourage companies that did not comply with the Electronic Bookkeeping Law to promote the digitization of books and documents, the requirements for electronic storage of electronic transactions have become stricter. I did. How you perceive this system will vary from company to company. It has been a long time since it was called work style reform, but the promotion of telework in Korona-ka, the automation of work by RPA, and the efforts for DX have become major trends in society as a whole. In the future, not only the response to the revision of the Electric Book Law, but also various efforts for digitalization both inside and outside the company will be required. Here, let's summarize the points of the revision of the Electric Book Law in electronic transactions.

Initially, it was planned to make it mandatory to store electronic transaction data from January 2022, but there was a two-year grace period because many companies could not respond in time. How long does it actually take to respond? First of all, the invoice system is scheduled to start in October 2023 as an event that has an impact on compliance with the Electric Book Law. Since invoices are electronic transactions, we would like to promote support for the Electric Book Law at the same time. There are various types of electronic transactions to be saved, such as quotations, orders, receipts, invoices, invoices, EDI, emails, etc. depending on the business partner, and the format, timing, and corresponding person in charge also differ. Since it is difficult to make all of these correspond at the same time, we will organize them and proceed in order. It may take about a year to deal with all of them. At least by the fall of 2022, we must finish considering how to deal with it and start working on it. Of course, there are differences in the number of target business partners and operations depending on the company, so I can not say unconditionally, but I hope that you can refer to the above procedure as a model case.

[Electronic book storage method] Support for the electronic book method in EDI (web, mail), which will increase in the future, and seminar on automation / efficiency explanation by RPA (archive distribution) https://www.usknet.com/archives/20211119webinar/

■ Related sites

![Advantages of "Gravio" that can implement face / person recognition AI with no code [Archive distribution now]](https://website-google-hk.oss-cn-hongkong.aliyuncs.com/drawing/article_results_6/2022/2/25/98ceaf1a66144152b81298720929e8e7.jpeg)